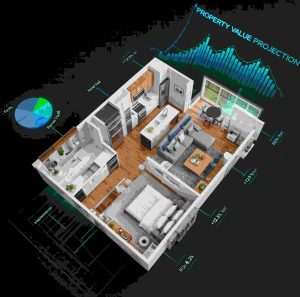

In analyzing property investments especially that of high end real estate like the private condominiums in Singapore, it is crucial to know the Vela Bay floorplan. But, it is also equally important to know how the financial and technological trends affect the value of property and its marketability. The Bayshore district of Singapore is rapidly transforming into one of the potential urban areas.

With that, a closer examination of the condominium design plans and the overall dynamics of investment may aid in the investors and home purchasers’ decision-making. This kind of synthesis is available in property floorplan strategy paired with financial and digital innovation. It will take your real estate, investment venture, and wealth-building strategy to the next level.

Why Property Investment Needs Floorplans?

A floorplan contains more than lines on a page. At its core is a blueprint which tells of how space, lifestyle needs, and future resale or rental value will be used, addressed, and impacted. Regarding the future of building plans such as Vela Bay located in the Bayshore area of Singapore, the floorplans are analyzed. The goal is for the investors and occupants to understand how floor plan layouts may enhance livability, flexibility to tenants, and general attractiveness in a competitive market.

The floorplans reveal the current usefulness of a home and its possible future worth. It is regardless of the efficient utilization of space to make the most out of natural light or the design that accommodates the multi-generational lifestyle. To investors, it can be viewed as an analytical method to financial and market data, and other market trends. Those can be used alongside the property evaluation. Therefore, the evaluation of property should be viewed not only as aesthetic but as holistic.

The Point of Real Estate and Financial Technology

When initially combining the idea of property floorplans with the trends of financial technology, it might seem that there is no relationship whatsoever. Yet, the correlation becomes more evident when you think about how digital technologies are affecting decision-making in the field of investment. Investment platforms now apply real-time analytics, algorithms and predictive modelling. It is to calculate risk, returns and recommend diversified portfolios which often include real estate assets. These are tools that assist in measuring how well property investments can perform relative to the overall market trends.

As an example, digital investment dashboards give users an overview of such physical assets as Singapore property trusts. It may also be linked to stocks and bonds to show how the idea of a physical structure, like a Bayshore condominium, fits the risk profile of the investor and their long-term objectives. This overlapping of property and digital finance is open to further discussion. It may also include something as detailed as the floorplan being included in discussions on larger portfolios.

Tech Trends Boosting the Analysis of the Property Market

The new technologies keep transforming the way financial data is being consumed and perceived. The concept of blockchain, artificial intelligence, and automation is changing the entire scope of payment systems. It is connected to prediction models employed by analysts and investors. Those tools will help in achieving more precise property values and enhanced risk analysis. Thus, it simplified the process of investment decision making.

Machine learning models can predict supply and prices of properties such as Bayshore condos. They can analyze thousands of variables, such as location, transit access, supply predictions, historical price changes. In the meantime, digital real estate services frequently combine interactive floor plans with virtual tours. This is where investors have the option of reviewing spatial arrangements prior to visiting the property.

Investment Strategy: Trade-Off between Layout Insights and Financial Objectives

Floorplan review in relation to macro-financial information should be coupled with those investors who may want to explore opportunities in the residential property market. Long-term property performance is also affected by factors such as interest rates, demographic changes, rental demand and digital finance trends.

The layout configured into an apartment can influence the demand of the property. Larger and versatile layouts would be more desirable to families. Whereas small and efficient ones would be appreciated by young professionals. In conjunction with financial forecasts induced by innovative technological devices, this expertise will assist an investor to develop a strong approach.

It should be a strategy in which his or her property decisions are in balance with both living patterns as well as economic facts.

Digital Literacy and Wealth Building

The current and future investors and house buyers are obliged to adopt property basics as well as digital financial literacy. The same way it is beneficial to know how to read a floorplan to learn about property valuation. It is important to learn how financial technology will enable investment analysis to make holistic decisions. Combining these areas, you get to understand the performance of the assets. You can also learn how they can be incorporated in diversified portfolios created to grow over time.

Regardless of the single trends of technology and the assessment of conventional assets, the point is to make a difference between physical and digital insights of investment. It is for this reason that choices are well-founded in the present, and future-oriented state.

Conclusion

With the interplay between property design, financial innovation, and technology, a framework of the powerful systems in navigating investments in real estate is formed. Analyzing the floorplan of the Vela Bay within the framework of larger trends in finance and technology provides investors with a more sophisticated vision. A vision that’s not only an understanding of space, but also a digital prospect. As the property landscape in Singapore keeps changing, this sort of integrated analysis will serve to make more intelligent wealth-building decisions.

The world of cryptocurrency is fast, unpredictable, and constantly evolving. One of the latest trends that’s gaining attention in both finance and tech circles is crypto arbitrage software. In simple terms, it’s a tool that helps users buy cryptocurrency on one exchange where it’s cheaper, and then sell it on another exchange where it’s more expensive. The small difference in price creates a profit. This process, known as arbitrage, has been prevalent in traditional finance for years; however, with the rise of digital currencies, it has become more accessible through automation.

The world of cryptocurrency is fast, unpredictable, and constantly evolving. One of the latest trends that’s gaining attention in both finance and tech circles is crypto arbitrage software. In simple terms, it’s a tool that helps users buy cryptocurrency on one exchange where it’s cheaper, and then sell it on another exchange where it’s more expensive. The small difference in price creates a profit. This process, known as arbitrage, has been prevalent in traditional finance for years; however, with the rise of digital currencies, it has become more accessible through automation.